Our annual Talent & People Practices Benchmark Survey provides a comprehensive review of how Norwest portfolio companies are approaching people operations, talent acquisition, organizational development, and systems and tools. The results give us a glimpse into how companies foster culture, retain talent, and tackle shared challenges, yielding a critical touchstone for our portfolio companies and their HR leaders.

Last year, we documented how HR trends shifted in response to the COVID-19 pandemic. This year, our data shows a tenuous tug-of-war as companies balance deteriorating market conditions with investing in the employee experience.

Collecting the insights from 121 people leaders in our portfolio, the 7th annual Talent & People Practices Benchmark Survey uncovered pressing HR questions, including:

-

- How do people leaders balance employee satisfaction with startup belt-tightening in an economic downturn?

- Which benefits will companies scale back to conserve cash?

- What benefits are table stakes companies must offer to retain employees and attract the best talent—regardless of market conditions?

Norwest’s Talent and People teams analyzed the survey responses to find answers to the questions above, as well as the questions they are being asked most often by HR teams in the Norwest community. I’ve compiled our takeaways below and hope the survey results provide timely guidance for HR leaders as they adjust their forecasts and set their strategies for 2023.

Companies are not cutting back on benefits

Undeterred by market woes, companies view employee experience as table stakes.

In the past few years, there’s been heightened attention on the employee experience, spurring employers to expand benefits that support workers throughout their personal and professional lives. Despite economic headwinds, companies are forging on with their pursuit of the whole-person employee experience.

Our 2022 Talent & People Practices Benchmark Survey showed companies are increasingly investing in core benefits like PTO, remote work, and parental leave as well as perks such as learning and development programs, mental health services, and fitness memberships.

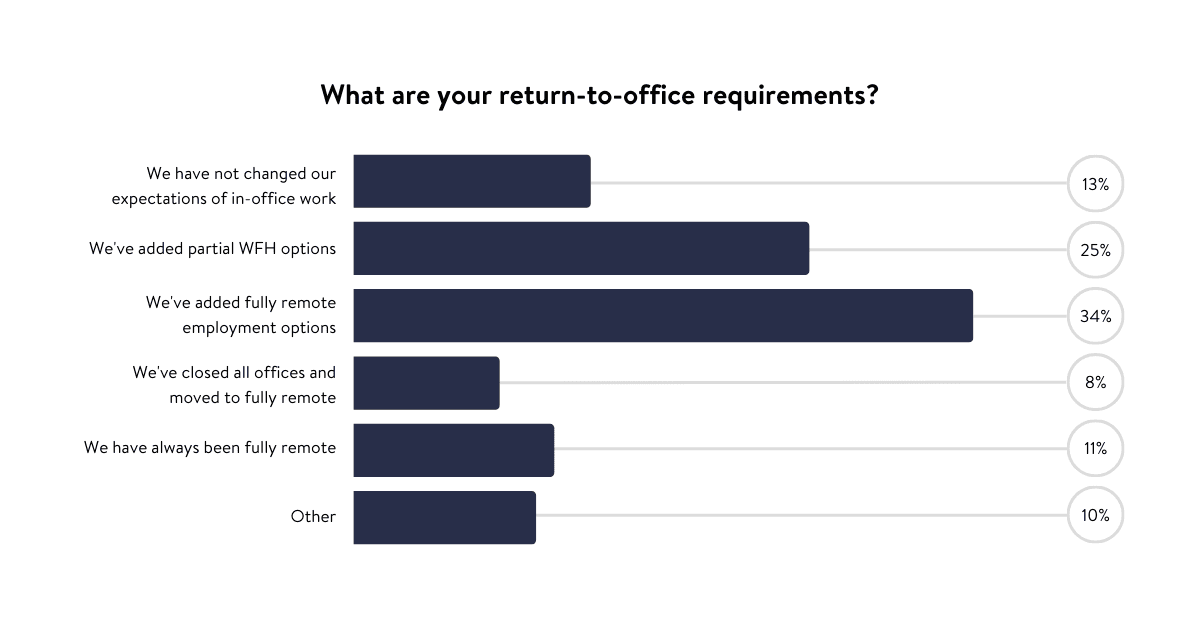

Remote work is a large component of return-to-office policies. About two-thirds of companies have added some form of remote work opportunity, with 34 percent offering options for fully remote roles, and 25 percent for partially remote or hybrid roles. About 8 percent of surveyed companies have closed offices entirely.

The pandemic’s cascading and lasting impact on remote work shed light on the advantages of a distributed workforce. Employees value flexibility and are reportedly happier in remote or hybrid roles. Companies also save money on leasing office space when they have partial or entirely remote teams. With more companies reducing their monthly burn in this uncertain economy, reducing office footprint can represent material cost savings. And while it’s still too early to understand the long-term impact of remote work, companies will do well to embrace flexibility for employees.

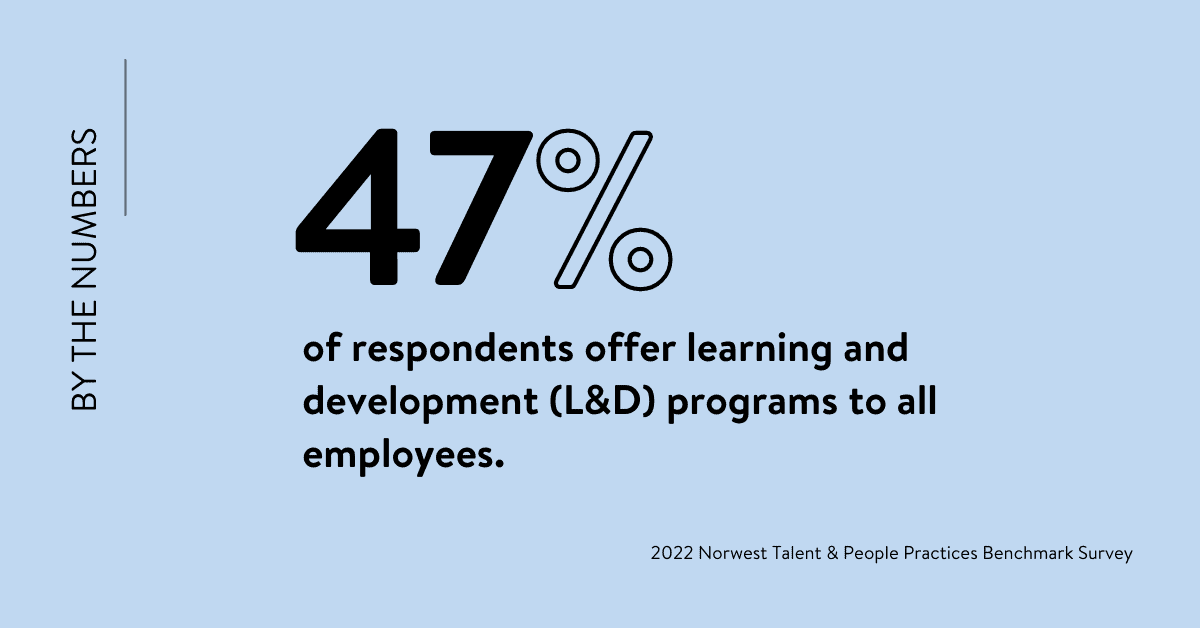

L&D programs make a rebound amid the “war for talent.” Our 2022 report reveals that 47 percent of companies now offer learning and development (L&D) options to all employees. In 2021, only 33 percent of companies provided L&D opportunities versus 40 percent in 2019.

The increase in companies implementing L&D programs for all employees is certainly a nod to the dynamics of remote work. Without employees in the office full-time, there are fewer opportunities to learn and absorb information in the organic way it tends to happen in the office. I believe companies also view L&D programs as a means to both attract and retain top talent. In this continued “war for talent,” employers want to compete for—and hold onto—the top candidates, and focusing on L&D is one way to do that.

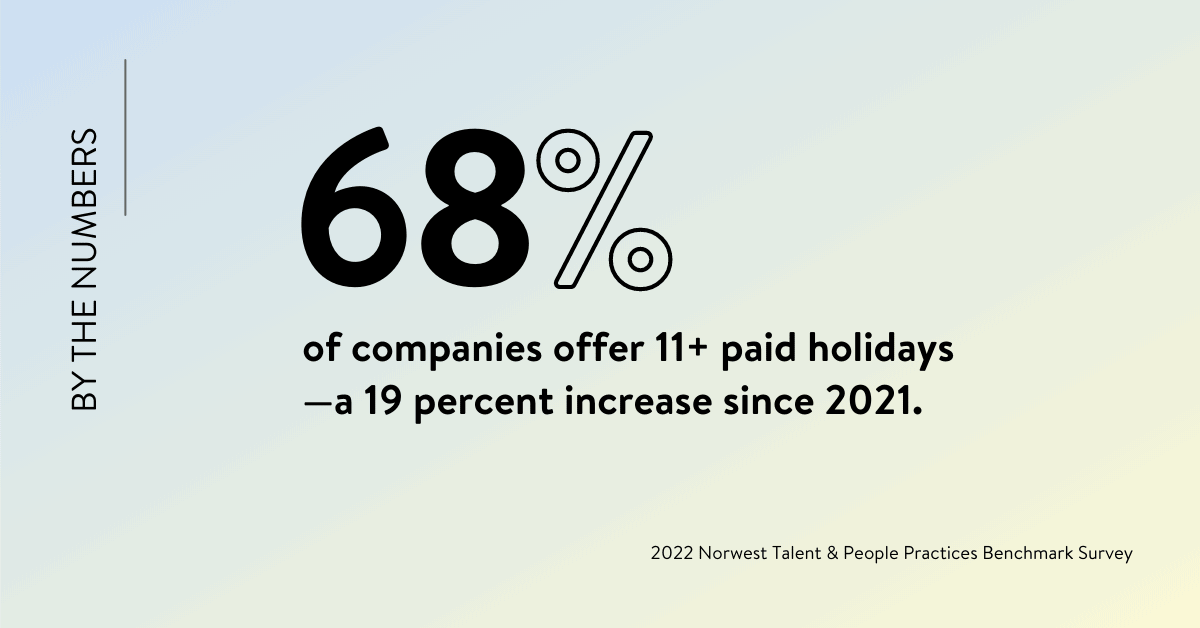

Companies offer more paid days off (if they’re tracking PTO at all). Since 2021, more companies have increased the number of paid days off that they offer, with 68 percent providing 11 or more paid holidays a year. There was also a 45 percent increase in the number of companies offering 16+ days of PTO a year to employees in their first year of employment. However, we saw a significant drop in the number of companies tracking PTO due to the rising popularity of unlimited PTO policies.

More companies shift to unlimited PTO. Offering unlimited PTO offers the perception of employee flexibility and it removes liability from the balance sheet in states like California where accrued PTO is required to be paid out to employees. Unlimited PTO has largely been a recruitment tool for companies despite receiving negative attention after studies showed that employees took less time off when companies offered it. That trend reversed this year, with employees averaging more days off under an unlimited PTO plan versus a traditional plan. It seems that the blurred lines of working from home (or living at work?) have shown employees the benefits of a healthier work/life balance.

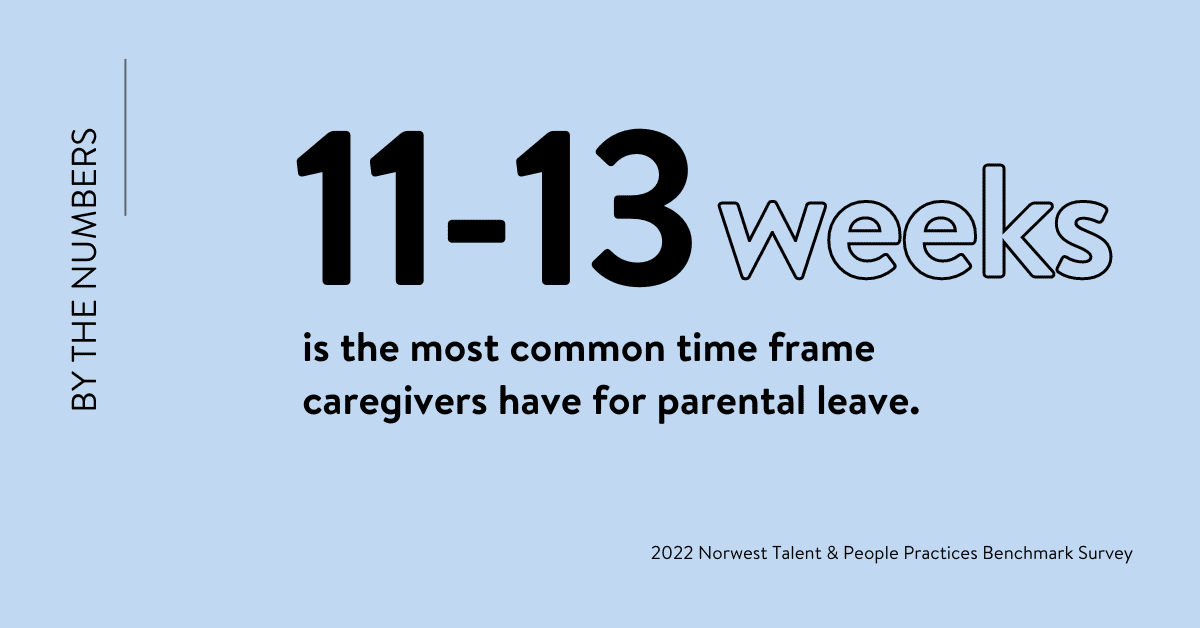

Equality for parental leave holds strong. Parental leave benefits remained largely the same from 2021, continuing an encouraging trend. About 75 percent of companies we surveyed do not differentiate between primary and secondary caregivers, which points to a larger movement that promotes equality for all parents.

Companies are looking to conserve budget

As economic uncertainty looms, employers recast their priorities for compensation as well as DEI programs—clashing with employee expectations.

The findings from our 2022 Talent & People Practices Benchmark Survey highlighted the disconnect between employee compensation expectations and employer budget constraints. Both sides are feeling the heat of rising inflation costs and budgetary concerns of the market downturn, culminating in market conditions we haven’t quite seen before.

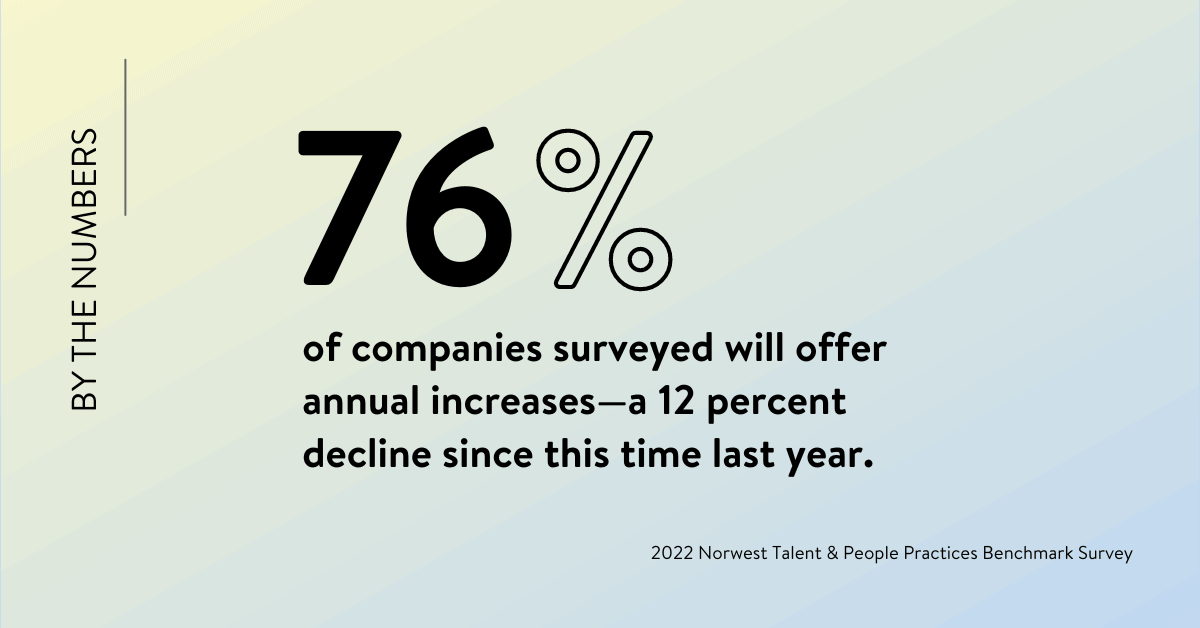

Annual increases on the decline. Overall, the percentage of companies offering annual increases fell from 86 percent to 76 percent—nearly a 12 percent decrease since 2021. The drop appears to be at odds with many employees’ expectations that annual increases will at least cover inflation costs this year. In previous downturns, I often heard that people were just happy to have job security, but with living costs constricting household income, many employees expect to see raises.

The value of DEI programs is still being understood. Only one-third of companies have diversity recruiting goals and DEI training programs in place as of this year. Unfortunately, the percentage of respondents who named DEI as a priority for the coming year dropped from 47 percent to 38 percent—nearly a fifth less than the companies who prioritized it last year.

This data underpins the disconnect between employer priorities and employee expectations. Throughout this year, I’ve been included in many hiring processes, including advising our portfolio companies on hiring, and nearly every single candidate asks what DEI programs are in place. It’s a major factor for talent evaluating a potential employer—predominantly Gen Z, the first minority-majority generation and remarkably vocal about seeing more diversity in the workplace (primarily in senior leadership positions).

Earlier this year we welcomed senior advisors Rachel Williams (DEI) and Shu Dar Yao (ESG) to our team, strengthening our commitment to progress in creating broader representation in our industry. Our Portfolio Services team continues to support our portfolio founders, CEOs, and their teams in building diverse, equitable, and inclusive companies.

Hiring and talent acquisition plans are scaling back

The “war for talent” seems to be cooling off as companies trade in their growth-at-all-costs mindsets for a more sustainable approach.

Our 2022 Talent & People Practices Benchmark Survey indicated that hiring will scale back in 2023. The workforce landscape is changing fast though. In late summer when we solicited survey responses, we were already seeing the news of companies undergoing large-scale layoffs. Since then, and as recently as this week, more companies have announced reductions in force (RIFs) and/or hiring freezes. I wrote about clear, compassionate communication for handling RIFs in Harvard Business Review, which I encourage company leaders to read.

Companies are planning to hire fewer people. The number of companies planning to hire 21+ employees in the next 12 months fell to 55 percent in 2022, a 14 percent decline from 2021. This shift is part of a larger trend to optimize budgets as businesses look to do more with less.

Companies are utilizing in-house talent acquisition teams more. The number of companies utilizing internal talent acquisition (TA) teams has steadily increased over the past few years, and in 2022 we saw a near 50/50 split between companies that do and don’t use internal TA teams. A sizable portion (37 percent) of companies reported that their internal TA team brought in over three-quarters of the new hires at the company.

We expect this trend to slow in the coming quarters as budgets tighten and growth plans are cut back. There will likely be an increased focus on leveraging internal teams, but teams will be leaner and more attuned to measuring their productivity. We are also beginning to see companies supplement with contractors on an “as needed” basis, an approach that is easier to scale up or down as conditions change.

Companies may pay more per hire. Hiring costs seem to be reverting back to pre-pandemic levels. In 2022, 30 percent of companies reported an average cost per hire to be between $5-10k versus 22 percent of companies in 2021 who reported the same. The hiring cost efficiencies gained last year look like a blip on the radar, which could put a strain on budgets as companies look to optimize across all aspects of business.

The opportunities that lie ahead in 2023

It’s hard to forecast how the economy will shape the HR landscape in the next 12 months. It’s likely many people leaders will have tough conversations as their companies make complex trade-offs. I find it incredibly helpful to understand how my peers are navigating unknowns, and hope our 2022 Talent & People Practices Benchmark Survey findings can provide that guidance for your 2023 plans.

My parting wisdom is to be as open, kind, and transparent as you can be with your employees. Compassion goes a long way in overcoming challenging circumstances, which holds true in any market.

I’d like to thank Laura Buckingham Thomas for driving this survey year after year, as well as our dedicated Talent leaders Teri McFadden, Kris Snodgrass, Lauren Heller, and Julia Lewis for their insightful analysis.

Watch Our Webinar Discussing The Findings